nebraska inheritance tax calculator

If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000. For any amount over 12500 but not over 25000 then the tax rate is 6 plus 625.

Inheritance Tax On House California How Much To Pay And How To Avoid It

In other words they dont owe any tax at all unless they inherit more than 40000.

. Late payment of the tax may also result in a hefty interest obligation. An inheritance tax is usually paid by a person inheriting an estate. The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the county board of commissioners with a population more than 2000000 or more.

In many states the estate tax ranges from 08 to 16. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Iowa which has an inheritance tax exempts transfers to lineal descendants children grandchildren etc and lineal.

It is noticeable from Figure 2 that the tax rate for Nebraskas inheritance tax changed in 2007. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

Of Nebraskas neighbors Colorado Wyoming South Dakota and Kansas do not have an inheritance tax. Nebraska inheritance tax is computed on the fair market value of such annuities life estates terms for years remainders and reversions reversionary interests. The states with the highest estate tax rates are Hawaii and Washington where the tax ranges from 10 to 20.

Nebraska does have an inheritance tax. The siblings who inherit will then pay a 11-16 tax rate. Table S Single Life Factors Based on Life.

The inheritance tax is levied on money already passed from an estate to a persons heirs. Nebraska has an inheritance tax. On a statewide basis the inheritance tax collections have ranged from 189 to 733 million since 1993 337 to 745 million if adjusted for inflation into 2020 dollars.

The federal gift tax allows a 15000 exemption amount per year and per person. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska.

Nebraska Gift Tax Inheritance Tax. Nebraska transfer tax calculator. Exemption amounts also vary from state to state.

The unique feature about Nebraskas inheritance tax is that it was and still is the only state in the nation to use this tax as a local revenue source. In short if a resident of Nebraska dies and their property goes to their spouse no inheritance tax is due. If it goes to an aunt uncle niece nephew or any lineal decedent.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. In fact most states choose not to impose a tax on time-of-death transfers. Instead the states use a progressive tax taking a larger cut of estates that are worth more.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. Nebraska Inheritance and Gift Tax. Computing real estate transfer tax is done in increments of 500.

State inheritance tax rates range from 1 up to 16. Below we provide a comprehensive look at Nebraska inheritance laws. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023.

In addition property that is the subject of either. If it goes to their parents grandparents siblings children or a lineal decedent or their spouse then the tax is applied to anything over 40000 at a rate of 1. Ive got more good news for you.

When the decedent leaves behind children how much the surviving spouse is entitled to is dependent on who the childrens parents are according to Nebraska inheritance laws. Anything above 15000 in value is subject to a 13 inheritance tax. Nebraska does not have a gift tax.

The nebraska state sales and use tax rate is 55. If the same rate is in effect for more than one month the link provided above is to the first IRS revenue ruling for that period. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money.

Nebraska Sales Tax Calculator By email protected On September 2 2021 Every 2021 combined rates mentioned above are the results of nebraska state rate 55 the county rate 0 to. The first 50000 is taxed at 10. The tax including interest and penalties is a lien upon any Nebraska real estate until paid.

The Nebraska tax calculator is updated for the 202223 tax year. The major difference between estate tax and inheritance tax is who pays the tax. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax and has remained relatively the same for the last 120 years.

Not all states do. The highest inheritance tax is in Nebraska where non-relatives pay up to 18 on the wealth they inherit. The fair market value is the present value as determined under the provisions of the Internal Revenue Code of 1954 1986 as amended and its applicable.

However if the exemption amount is lower the executor will calculate the tax due based on the difference applied at a tax rate of approximately 40. Nebraska inheritance tax is computed on the fair market. If you leave money to your spouse.

Under Nebraska rates the five children would pay a total of 9500 while the tax on the nonrelative would be 1774204 II. The inheritance tax is due and payable within 12 months of the decedents date of death and a penalty is assessed for failure to file timely the appropriate inheritance tax return. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests.

In addition property that is. Surviving spouses are always exempt. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit.

Click here for all current and prior IRS revenue rulings. Thus a practitioner is well advised to note that insurance proceeds payable to a specific beneficiary or living trust will not be subject to tax. How is this changed by LB310.

Up to 25 cash back Close relatives pay 1 tax after 40000. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. The rate depends on your relationship to your benefactor.

If every one of the children are that of the decedent and surviving spouse the spouse inherits 100000 of the estate and half of the estates balance. By contrast a nephew in Iowa has a different tax rate. Currently the first 15000 of the inheritance is not taxed.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500.

Nebraska Income Tax Calculator Smartasset

How Much Money Can You Inherit Tax Free Inheritance Tax Calculator Banks 2022 Daily4mative

How To Calculate Inheritance Tax 12 Steps With Pictures

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

How To Calculate Inheritance Tax 12 Steps With Pictures

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Maryland Inheritance Tax Calculator Probate

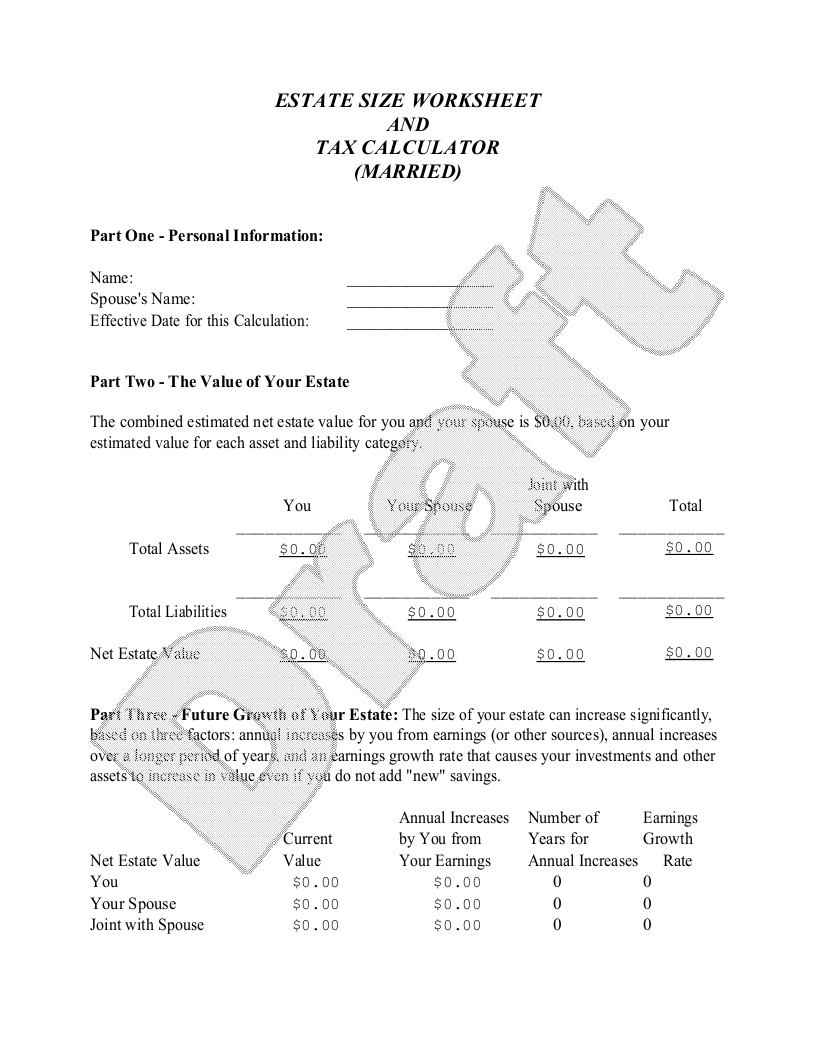

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate Inheritance Tax 12 Steps With Pictures

How Do I Calculate My Executor S Fee Legacy Design Strategies An Estate And Business Planning Law Firm

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Inheritance Tax Update Center For Agricultural Profitability

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)